11+ Ct Paycheck Calculator

The top rate is 12 for the portion of any estate that exceeds 101 million in value. First determine the total number of hours worked by multiplying the hours per week by the number of weeks in a year 52.

9 Payroll Budget Templates Free Sample Example Format Download

Find Your Perfect Payroll Partner Today.

. Ad Compare a List Of Popular Paycheck Tools and Bookmark the Ones That Best Meet Your Needs. Web Calculate your Connecticut net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Connecticut paycheck calculator. Web The Chancellor of the Exchequer presented his Autumn Statement to Parliament on Wednesday 22 November 2023.

Enter your info to see your take home pay. Web Calculate your Connecticut paycheck. By having a thorough understanding of how much money youll be taking home after taxes and deductions youll have a better chance of getting the salary you need and deserve.

Web SmartAssets Connecticut paycheck calculator shows your hourly and salary income after federal state and local taxes. Web Use Connecticut Paycheck Calculator to estimate net or take home pay for salaried employees. Connecticut tax year starts from July 01 the year before to June 30 the current year.

Estates with a taxable value above 91 million must pay the estate tax. You can also use the paycheck calculator CT. This is the withholding amount per pay period.

Web Calculate your Property Taxes. For example if an employee has a salary of 50000 and works 40 hours per week the hourly rate is 500002080 40 x 52 2404. This is the total withholding amount.

100 15 85. Click here to view the Tax Calculators now. The PaycheckCity salary calculator will do the calculating for you.

This number is the gross pay per pay period. Subtract any deductions and payroll taxes from the gross pay to get net pay. Monthly Connecticut Withholding Calculator - CT-W4P.

If youre an employee generally your employer must withhold certain taxes such as federal tax withholdings social security and Medicare taxes from your. Web First the 2022 exemption amount in Connecticut is 91 million. Free for personal use.

Web Britains minimum wage will increase by 98 to 1144 pounds 1426 an hour from April 2024 making it one of the highest as a share of average earnings of any advanced economy. Ad Say Goodbye to Payroll Stress Errors. Switch to salary Hourly Employee.

Find 5 Payroll Services Systems 2023. Web Use our paycheck tax calculator. This Connecticut hourly paycheck calculator is perfect for those who are paid on an hourly basis.

Web How to Calculate Your Paycheck in Connecticut Are you a resident of Connecticut and want to know how much take-home pay you can expect on each of your paychecks. Affordable Easy-to-Use Try Now. This document sets out the estimated impact of changes to tax welfare and public.

Divide the result from Step 12 by the number of pay periods in the year Step 2. Simply enter their federal and state W-4 information as well as their pay rate deductions and benefits and well crunch the numbers for you. Rates begin at 116 for the first 1 million above the exemption.

GetApp Offers Free Service To Users and Helps Them Grow Their Businesses. Property Tax Credit Calculator. Social Security Benefit Adjustment Worksheet.

Web If your gross pay is 0 per -in the state of F your net pay or take home pay will be 134317 after tax deductions of 0 or 15683Deductions include a total of 1 0 or 000 for the federal income tax 2 0 or 000 for the state income tax 3 620 or 000 for the social security tax and 4 145 or 000 for Medicare. By using Netchexs Connecticut paycheck calculator discover in just a few steps what your anticipated paycheck will look like. Web Connecticut Paycheck Calculator Easily estimate take home pay after income tax so you can have an idea of what to possibly expect when planning your budget Last reviewed on January 29 2023 Optional Criteria See values per.

Web Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. Payroll Seamlessly Integrates With QuickBooks Online. The Connecticut set of progressive income tax rates has seven tax brackets with rates between 300 and 699.

Web Using a paycheck calculator CT can also help you when youre negotiating a salary or wage with a potential employer. SmartAssets hourly and salary paycheck calculator shows your income after federal state and local taxes. Web How do I calculate hourly rate.

Next divide this number from the annual salary. Calculating your Connecticut state income tax is similar to the steps we listed on our Federal paycheck calculator. Dont want to calculate this by hand.

Multiply the withholding amount Step 10 by 100 minus the decimal amount Step 11. So the tax year 2022 will start from July 01 2021 to June 30 2022. The following calculators are available from myconneCT.

No api key found. Web To calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year. For example if an employee earns 1500 per week the individuals annual income would be 1500 x 52 78000.

Figure out your filing status. Ad Approve Payroll When Youre Ready Access Employee Services Manage It All In One Place. Web To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year.

Web Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in Connecticut. Year Month Biweekly Week Day Hour Results Income Before Tax Take Home Pay Total Tax Average Tax. Enter your info to see your take home pay.

Web Use our free Connecticut paycheck calculator to calculate your net pay or take-home pay using your period or annual income and the required federal state and local W4 information. Simply input salary details benefits and deductions and any other necessary information as prompted below and let our tool handle the rest.

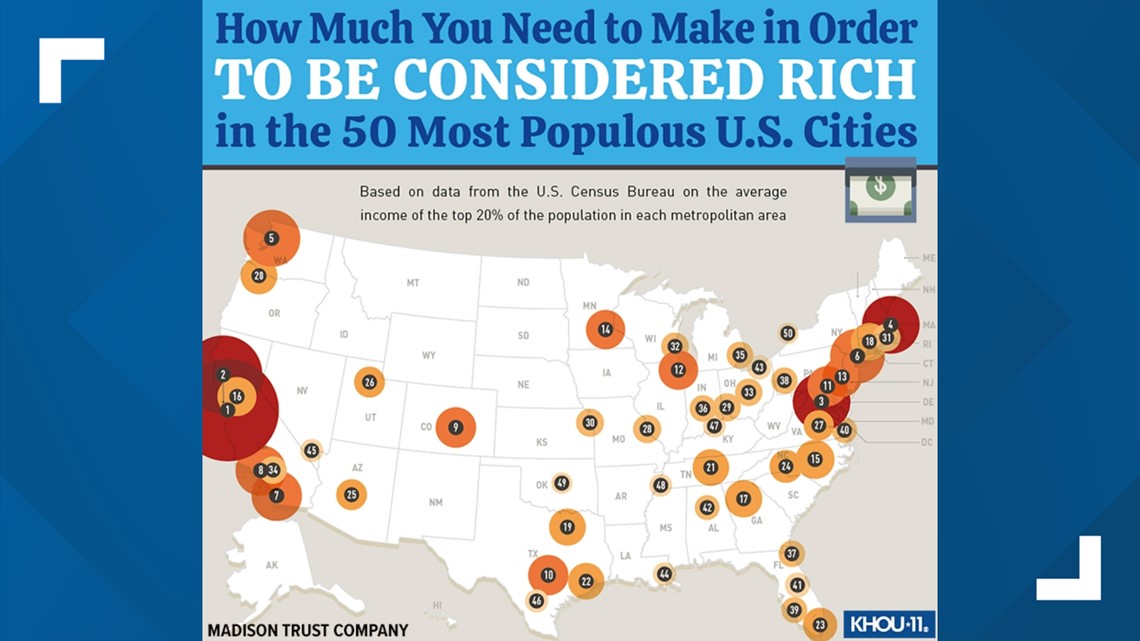

Study To Be Rich In Houston Your Salary Has To Be 260 958 Khou Com

Generic Ct 512 Wt N Basic Calculator New Version With Big Display 112

2023 Line Of Credit Calculator Bankrate Expenses Best Artbunese De

Ready To Use Paycheck Calculator Excel Template Msofficegeek

Ion Stopping In Dense Plasmas A Basic Physics Approach Topic Of Research Paper In Physical Sciences Download Scholarly Article Pdf And Read For Free On Cyberleninka Open Science Hub

Cltllzen Ct 512w Basic White Calculator 12 Digit Amazon In Office Products

11 Social Security Income Calculator Templates In Pdf

Policy Exchange The Island Of Ireland

How Do We Calculate The 30th Number In The Series 1 2 4 7 11 16 Quora

2023 Sam S Club Jobs Pay Easily Likely Ihrebaden De

Chapter 2 Research Findings Guidelines For The Use Of Pavement Warranties On Highway Construction Projects The National Academies Press

Cmzen Ct 8014 Calculator Kitaabnow

Tm2210317d1 Ex99 1img021 Jpg

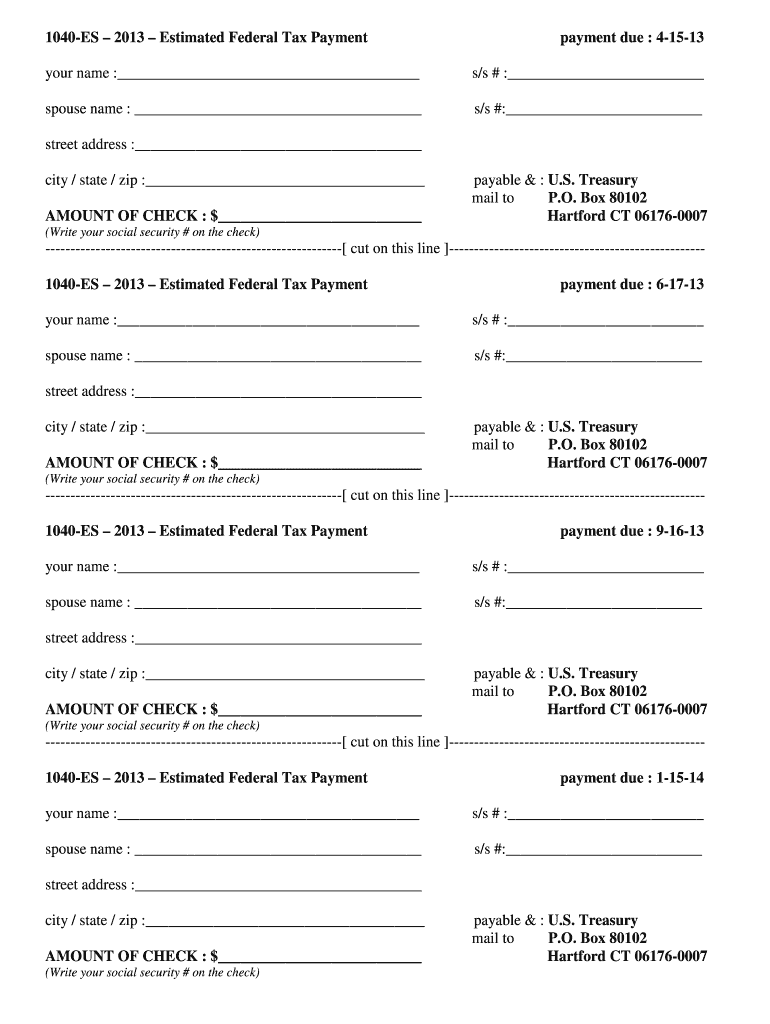

Tax Payment Report Worksheet Appendix D Form Fill Online Printable Fillable Blank Pdffiller

N Ceunes

Connecticut Paycheck Calculator 2023 Investomatica

Software Engineer Salary In Spain